In the chaos of the last week’s election, it was hard to believe that Bidenflation continues to be a steady force. Even though inflation was lower than expected for October, housing, food, and energy prices were still significant contributors to rising consumer costs.

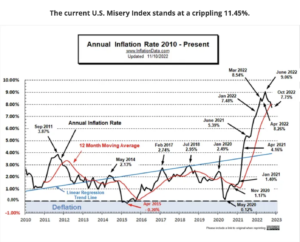

Economists have been using the most recent Bureau of Labor and Statistics data (BLS), to assess the economic health of a country since the 1970s. They add the current U.S. jobless rate (which rose to 3.7%) to October’s higher-than-expected U.S. inflation rate (currently at 7.75%). The original “discomfort index” was created by Arthur M. Okun (an intellectual powerhouse and policy economist). It is now simply known as the U.S. Misery Index. It functions as an indicator of the state of America’s economy at the time.

The Misery Index measures the impact of inflation and unemployment on American wages. The Misery Index is at an all-time high, which means that the quality of American lives declines as it rises. Even though inflation slowed slightly in October, there are no signs that it is slowing down. This led to the Fed raising interest rates to their highest level since 2008.

The slight decrease in the U.S. inflation rate in October doesn’t necessarily mean that prices for goods or services have fallen; it just means that prices aren’t increasing as fast as they were earlier this year. According to the most recent BLS news release, inflation has not affected only a few price segments of the economy. The Consumer Price Index (CPI), which tracks the change in prices consumers pay for goods and services, increased by 0.4% in October. The largest contributors to the month-to-month seasonally adjusted all items increase were the prices of shelter, gasoline, and food. The month saw increases in motor vehicle insurance, personal care, recreation, new cars, and auto insurance. The only things that saw a decrease were used cars and trucks, medical services, apparel, and airline fares.

Many Americans are planning to reduce holiday spending and travel, despite everyday consumer prices nearing record levels. They are not wrong. AAA reported that Sunday’s national gasoline average was $3.776 per gallon. This is $0.137 less than in October, but $0.362 more than last year. The Western states continue to have high gas prices. California’s average price for gasoline is $5.441/gallon.

US wage growth has failed to keep pace with rising consumer prices for a record 19 consecutive months. This is a decline in prosperity for the American worker and the primary reason why the Fed will continue to hike rates.

Charting via @ycharts pic.twitter.com/BnPqRKh2pe

— Charlie Bilello (@charliebilello) November 10, 2022

Soaring wages, stagnant wages, rising mortgage rates, credit card debt, and no end — all due to Biden & Co.’s disastrous economic policies — raise the question: “Is this really what Americans, especially Gen Z, voted for on November 8?” If so, why?

Biden has said that he will not change his policies. Of course, Biden is not going to change his policies because he is rich and doesn’t know how hard it is for the average American to buy groceries, provide for their family, and survive.