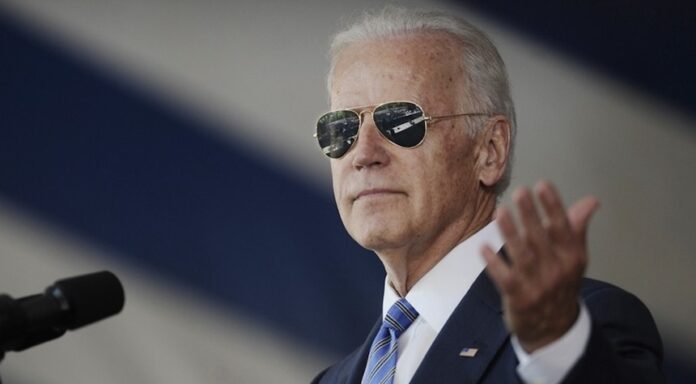

President Joe Biden recently touted the strength of the US economy, but Monday morning, it looked like everything was falling apart. The New York Stock Exchange halted trading of Charles Schwab, whose shares fell by over 20%, and even some Etsy sellers felt the impact of Silicon Valley Bank’s (SVB) collapse.

Trading of shares in over 30 banks was halted on Wall Street, as the entire sector suddenly looks like risk investors aren’t willing to take. Almost everything banking was down in pre-market trades, which MarketWatch described as “panic-like activity.”

SVB and Signature Bank are the second-and third-largest bank failures in US history, respectively, with combined assets in excess of $300 billion. Investment holdings at SVB are wiped out. “When the risk didn’t pay off, investors lose their money. That’s how capitalism works,” Biden said in his national address on Monday.

What went wrong? Inflation. The higher interest rates needed to combat inflation smashed the cheap-money expectations that SVB’s bond portfolios required. Other sectors of the economy that have become addicted to historically low-interest rates include high-tech, particularly startup firms, and the housing market.

“It’s been one helluva morning, and that’s just in the banking sector. Looks like it’s time to haul out the Chart of Doom that surfaced on the internet back in 2008,” wrote one journalist.

On Sunday, Etsy reported that “a small group of sellers… had their payments delayed on Friday” due to impacts from SVB’s implosion. Some sellers have been forced to put their stores in “vacation mode” because, without any money coming in, they can’t afford to pay for shipping on orders going out to customers.

Inflation remains stubbornly high, due in large part to the Fed being both slow and timid in its rate hikes. Nevertheless, Goldman Sachs analysts wrote in an investor’s letter on Sunday that “we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March.”

If the problems we’re seeing in the banking system take a toll on consumer and investor confidence, then the Fed will do what it always does in that situation: easy money. But easy money during an inflationary period just adds fuel to the fire.

“We’ve made strong economic progress in the past two years,” Biden said Monday. The RNC Twitter account responded with a few inconvenient truths: “When Biden took office, inflation was at 1.4% and gas was $2.39/gal. Today, inflation is at 6.4% and gas is $3.47/gal.”

It’s not just the big players getting hurt in the Biden economy, but there could be worse to come. If inflation continues to soar, the impact on the economy could be disastrous. As one journalist wrote, “Laugh. It beats crying — unless you’re one of those Etsy sellers who hasn’t been paid”.